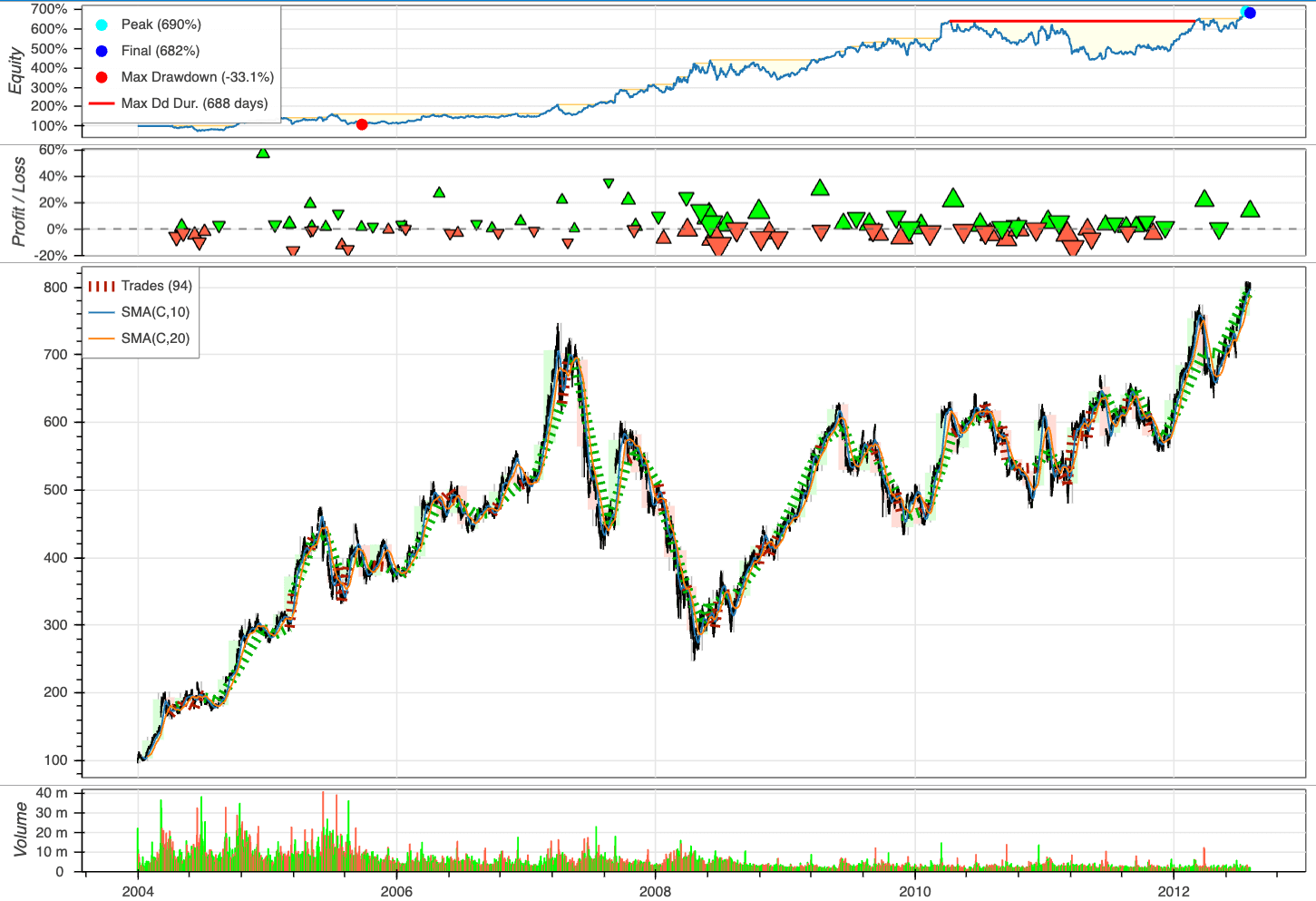

Evaluating trading strategies’ effectiveness is crucial for financial decision-making, but it’s challenging due to the complexities of historical data analysis and strategy testing.

Backtesting allows users to simulate trades based on historical data and visualize the outcomes through interactive plots in three lines of code.

To see how Backtesting works, let’s create our first strategy to backtest on these Google data, a simple moving average (MA) cross-over strategy.

from backtesting.test import GOOG

GOOG.tail() Open High Low Close Volume

2013-02-25 802.3 808.41 790.49 790.77 2303900

2013-02-26 795.0 795.95 784.40 790.13 2202500

2013-02-27 794.8 804.75 791.11 799.78 2026100

2013-02-28 801.1 806.99 801.03 801.20 2265800

2013-03-01 797.8 807.14 796.15 806.19 2175400import pandas as pd

def SMA(values, n):

"""

Return simple moving average of `values`, at

each step taking into account `n` previous values.

"""

return pd.Series(values).rolling(n).mean()from backtesting import Strategy

from backtesting.lib import crossover

class SmaCross(Strategy):

# Define the two MA lags as *class variables*

# for later optimization

n1 = 10

n2 = 20

def init(self):

# Precompute the two moving averages

self.sma1 = self.I(SMA, self.data.Close, self.n1)

self.sma2 = self.I(SMA, self.data.Close, self.n2)

def next(self):

# If sma1 crosses above sma2, close any existing

# short trades, and buy the asset

if crossover(self.sma1, self.sma2):

self.position.close()

self.buy()

# Else, if sma1 crosses below sma2, close any existing

# long trades, and sell the asset

elif crossover(self.sma2, self.sma1):

self.position.close()

self.sell()To assess the performance of our investment strategy, we will instantiate a Backtest object, using Google stock data as our asset of interest and incorporating the SmaCross strategy class. We’ll start with an initial cash balance of 10,000 units and set the broker’s commission to a realistic rate of 0.2%.

from backtesting import Backtest

bt = Backtest(GOOG, SmaCross, cash=10_000, commission=.002)

stats = bt.run()

statsStart 2004-08-19 00:00:00

End 2013-03-01 00:00:00

Duration 3116 days 00:00:00

Exposure Time [%] 97.067039

Equity Final [$] 68221.96986

Equity Peak [$] 68991.21986

Return [%] 582.219699

Buy & Hold Return [%] 703.458242

Return (Ann.) [%] 25.266427

Volatility (Ann.) [%] 38.383008

Sharpe Ratio 0.658271

Sortino Ratio 1.288779

Calmar Ratio 0.763748

Max. Drawdown [%] -33.082172

Avg. Drawdown [%] -5.581506

Max. Drawdown Duration 688 days 00:00:00

Avg. Drawdown Duration 41 days 00:00:00

# Trades 94

Win Rate [%] 54.255319

Best Trade [%] 57.11931

Worst Trade [%] -16.629898

Avg. Trade [%] 2.074326

Max. Trade Duration 121 days 00:00:00

Avg. Trade Duration 33 days 00:00:00

Profit Factor 2.190805

Expectancy [%] 2.606294

SQN 1.990216

_strategy SmaCross

_equity_curve ...

_trades Size EntryB...

dtype: objectPlot the outcomes:

bt.plot()