Table of Contents

Introduction

Have you ever noticed how a single chatbot can only analyze problems through one perspective at a time instead of weighing multiple viewpoints like humans do?

To demonstrate this, let’s see how a single agent would analyze Apple’s financial health:

from langchain_openai import ChatOpenAI

from langchain.prompts import ChatPromptTemplate

# Single agent approach

single_agent = ChatOpenAI(model="gpt-4")

prompt = ChatPromptTemplate.from_messages([

("system", "You are a financial analyst. Analyze the company's health from all angles."),

("user", "Analyze Apple's financial health considering growth, risks, and market position.")

])

# The agent tries to be both optimistic and pessimistic at once

response = single_agent.invoke(prompt.format_messages())

print(response.content)

The output might look like this:

Apple demonstrates a healthy financial status with consistent growth and a strong market position. Its innovative product pipeline, growing services segment, high-profit margins and robust balance sheets substantiate its stability.

There are several issues with this response:

- Confirmation Bias: The response tends to be one-sided (in this case, overly positive) because there’s no counter-balancing perspective. It’s like having only one voice in a debate.

- No Decision Making: The single bot only provides analysis without making any concrete decisions or recommendations.

This limited perspective makes it particularly challenging for complex tasks like investment analysis that require balancing different factors and perspectives.

LangGraph solves this by providing a framework for building coordinated multi-agent systems with specialized agents working together through structured communication.

Here’s how the same analysis would look with a multi-agent system:

Key bull arguments centered on Apple's strong financials (record Q1 2024 profits and cash, robust Services and ecosystem growth), operational resilience, and the potential for future innovation.

The bears countered with Apple's slowing annual growth, overreliance on iPhone, regulatory headwinds, China risks, and concerns about high valuation and lack of breakthrough innovation.

The chairman ultimately decided on a HOLD/RESEARCH MORE position, balancing Apple's financial strength and stability against meaningful macro, regulatory, and growth risks.

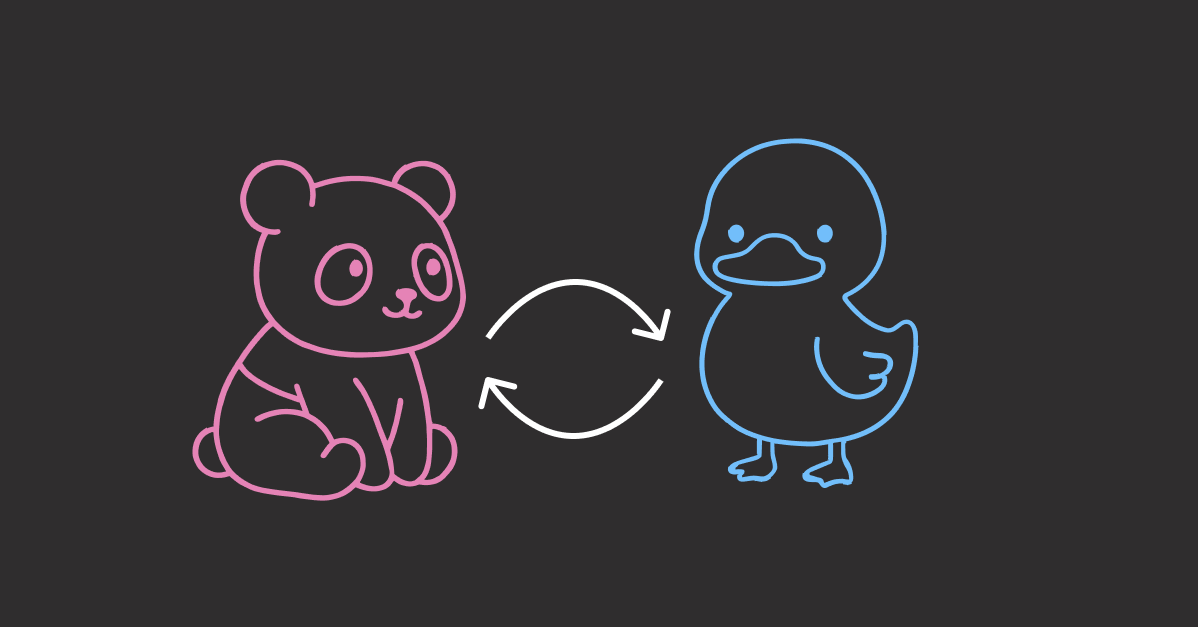

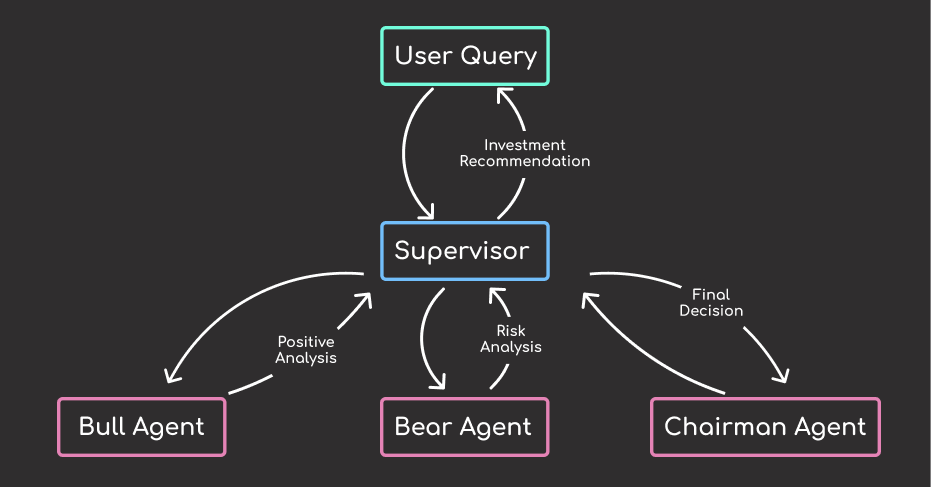

This example illustrates the structured debate process between specialized agents:

- The bull agent starts by making its investment case

- The bear agent responds by highlighting key risks

- The chairman carefully weighs both perspectives and makes a final decision

This multi-agent approach produces a more thorough and balanced analysis compared to a single agent trying to consider all angles at once.

Stay Current with CodeCut

Actionable Python tips, curated for busy data pros. Skim in under 2 minutes, three times a week.

Key Takeaways

Here’s what you’ll learn:

- Build coordinated multi-agent systems that debate from different perspectives instead of single biased responses

- Create specialized agents with distinct tools and prompts for bull/bear investment analysis

- Implement supervisor workflows that route conversations between agents in structured sequences

- Deploy production-ready investment committees with real-time market data integration

- Scale beyond finance to any domain requiring multiple viewpoints and structured decision-making

Getting Started with LangGraph

Environment Setup

First, you should setup your environment with the following packages:

pip install langgraph langgraph-supervisor langchain langchain-core langchain-tavily langchain-openai python-dotenv

These packages are necessary for our investment committee system:

langgraph: Core framework for building multi-agent systems with state managementlanggraph-supervisor: Provides the supervisor pattern for agent coordinationlangchainandlangchain-core: Foundational components for LLM applicationslangchain-tavily: Integration with Tavily search API for market researchlangchain-openai: OpenAI model integrationspython-dotenv: Environment variable management for API keys

Next, create a .env file and populate it with your API keys from OpenAI and Tavily (a search engine API).

TAVILY_API_KEY='your-api-key-goes-here'

OPENAI_API_KEY='your-api-key-goes-here'

Now, let’s see how to create your first agent in LangGraph.

Note that going forward, familiarity with LangChain basics will be helpful.

Creating Agents in LangGraph

LangGraph makes it very easy to create your first agent. Let’s walk through how to create a general purpose assistant with web search functionality in a few lines of code.

First, we load our environment variables containing API keys using load_dotenv() and import necessary components:

from dotenv import load_dotenv

from langgraph.prebuilt import create_react_agent

from langchain_openai import ChatOpenAI

from langchain_tavily import TavilySearch

load_dotenv()

Next, initialize the search tool with TavilySearch(max_results=3), which will return the top three search results for any query.

web_search = TavilySearch(max_results=3)

Create the agent using create_react_agent(), which implements the ReAct pattern, a framework that enables agents to reason about actions, execute them with tools, observe results, and plan next steps accordingly.

agent = create_react_agent(

model=ChatOpenAI(model="gpt-4o"),

tools=[web_search],

prompt="You are a helpful assistant that can search the web for information and summarize the results to enhance your output.",

)

We configure the agent with the three core components:

- A language model (GPT-4o in this case)

- A list of tools that allows the agent to connect to external tools and APIs like a search engine

- A system prompt that defines the agent’s role and behavior

Finally, we invoke the agent with a question about today’s stock market activity:

response = agent.invoke(

{

"messages": [

{

"role": "user",

"content": "Find the open and close prices of Apple's stocks for June 1, 2025."

}

]

}

)

print(response['messages'][-1].content)

June 1, 2025, was a Sunday, so financial markets were closed. The next trading day was June 2, 2025. On June 2, 2025, Apple's (AAPL) stock:

- Opened at: $200.28

- Closed at: $201.70

You can verify this information on trusted sources such as Yahoo Finance and Macrotrends:

- Source: Yahoo Finance (historical data page)

- Source: Macrotrends Apple stock history

If you need data for the trading day immediately before June 2, 2025, let me know!

The output demonstrates the ReAct pattern in action:

- The agent reasons about what information it needs (stock prices for a specific date)

- Executes the task using the web search tool to find the information

- Observes the results and reasons again about their validity

- Plans next steps accordingly (in this case, providing the data for the next trading day)

Creating a Supervisor Multi-Agent System

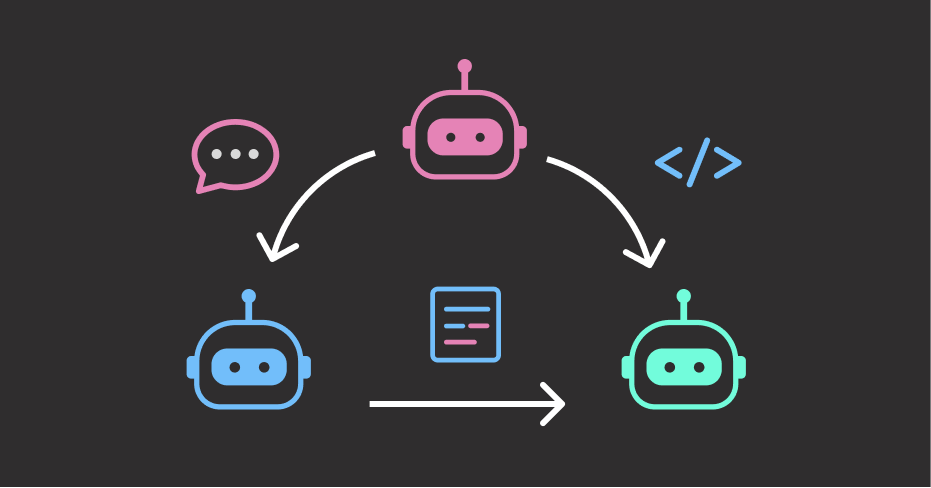

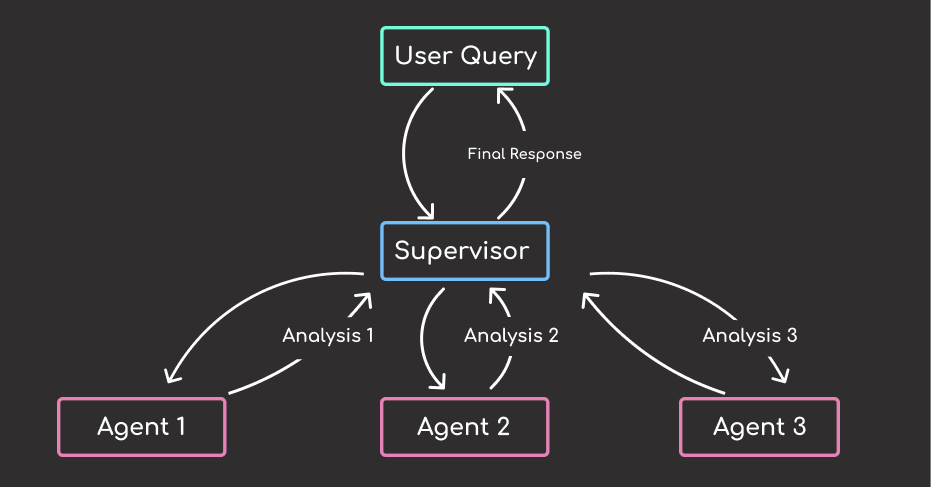

A supervisor is a special agent that manages the workflow between multiple agents. It is responsible for:

- Routing the workflow between agents

- Managing the conversation history

- Ensuring the agents are working together to achieve the goal

Let’s create a supervisor multi-agent system with three agents:

from langgraph_supervisor import create_supervisor

# Define domain-specific agents with their own tools and prompts

agent1 = create_react_agent(...)

agent2 = create_react_agent(...)

agent3 = create_react_agent(...)

# Create a memory checkpointer to persist conversation history for the supervisor

memory = MemorySaver()

supervisor = create_supervisor(

model=ChatOpenAI(model="o3"),

agents=[agent1, agent2, agent3],

prompt="Detailed system prompt instructing the model how to route the workflow.",

).compile(checkpointer=memory)

# Call the supervisor with a user query

response = supervisor.invoke({

"messages": [

{

"role": "user",

"content": "Your question here..."

}

]

})

The supervisor multi-agent system follows a structured workflow for processing user queries. Here’s how it works:

- User submits a query to the supervisor

- Supervisor routes the query to appropriate agents based on the system prompt

- Agents analyze the information independently and return their findings back to the supervisor

- Supervisor aggregates the findings and generates a final response

- The final response is returned to the user

Building the Investment Board of Agents

Now that we’ve covered the basics of LangGraph, let’s move on to explore the investment board of agents application.

High-level Application Overview

Here’s a high-level overview of the application:

investment-committee/

├── src/

│ ├── __init__.py # Package marker

│ ├── config.py # Prompts and model configuration

│ ├── tools.py # Agent tools organized by function

│ ├── utils.py # Utility functions for display

│ └── agents.py # Agent and supervisor creation

├── main.py # Command-line interface

├── requirements.txt # Python dependencies

├── .env.example # Environment variables template

└── README.md # Documentation

In this structure:

src/config.pycontains the system configurationsrc/tools.pycontains the tools for the agentssrc/utils.pycontains the utility functions for the applicationsrc/agents.pycontains the agent and supervisor creationmain.pyis the entry point for the command-line interface

Let’s go through each of these files in more detail.

Setting up configuration

The config.py file centralizes all system configuration in one location, making the application easy to customize and maintain. The file contains two main types of configuration:

- Model configuration: Specifies which language model to use across all agents, which is currently set to

"openai:gpt-4". - Agent prompts: Define the personality and behavior of each agent through detailed system prompts.

Here is the supervisor prompt:

SUPERVISOR_PROMPT = (

"You are a SIMPLE ROUTER with one final summary task.\n\n"

"MANDATORY WORKFLOW (follow exactly):\n"

"1. bull_agent: Make initial bullish case\n"

"2. bear_agent: Make initial bearish case\n"

"3. bull_agent: Counter the bear's specific arguments\n"

"4. bear_agent: Counter the bull's specific arguments\n"

"5. chairman_agent: Make final investment decision\n"

"6. YOU: Summarize the debate outcome\n\n"

"RULES:\n"

"- DO NOT summarize until AFTER chairman makes decision\n"

"- ALWAYS end with chairman_agent making the decision first\n"

"- Route agents in the exact order above\n"

"- After chairman decides, provide a brief summary of:\n"

" • Key bull arguments\n"

" • Key bear arguments \n"

" • Chairman's final decision and reasoning\n"

"- Keep summary concise (3-4 sentences max)"

)

Defining Tools

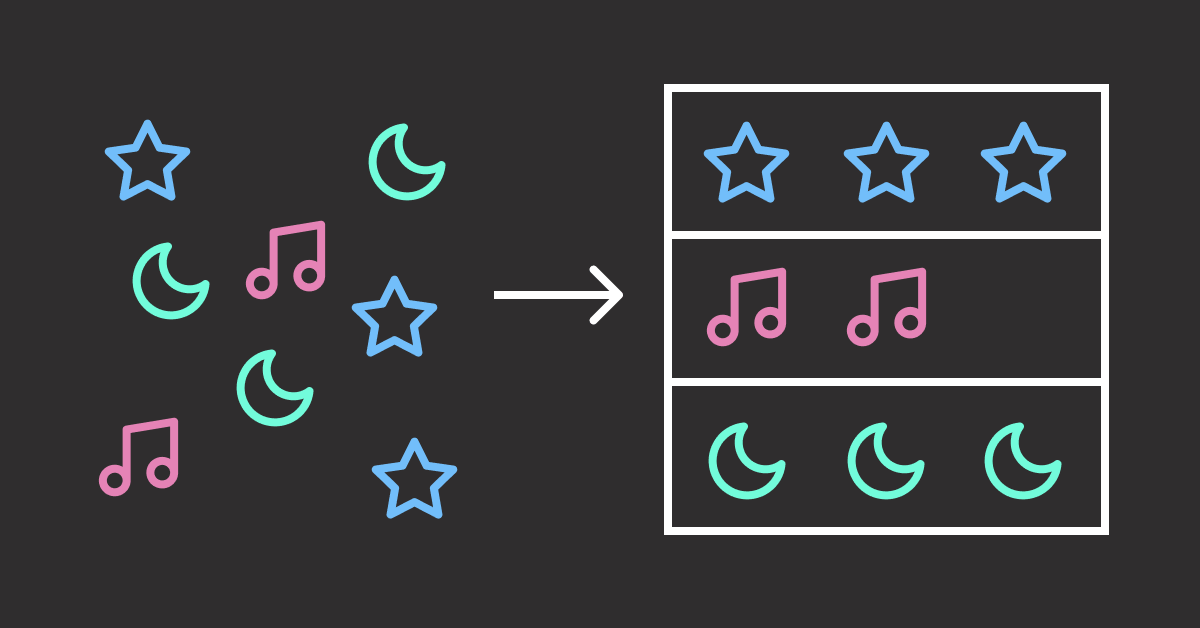

Tools are functions that agents can use to interact with external data sources and perform specific tasks. There are six tools used in this system:

find_positive_news: Searches for positive news and developments about a stockcalculate_growth_potential: Calculates basic growth metrics and bullish indicatorsfind_negative_news: Searches for negative news and risks about a stockassess_market_risks: Assesses overall market risks and bearish indicatorsget_current_market_sentiment: Gets overall market sentiment and recent performancemake_investment_decision: Makes final investment recommendation based on bull and bear arguments

Each tool uses the Tavily search API to gather real-time market information, ensuring agents base their arguments on current data rather than outdated training information.

Here is the code for the find_positive_news tool:

def find_positive_news(stock_symbol: str):

"""Search for positive news and developments about a stock"""

query = f"{stock_symbol} stock positive news earnings growth revenue profit upgrade"

keywords = ["profit", "growth", "upgrade", "beat", "strong", "positive", "bullish"]

prefix = "🐂 POSITIVE SIGNALS"

default = "Limited positive news found, but that could mean it's undervalued!"

return search_and_extract_signals(stock_symbol, query, keywords, prefix, default)

View the full code for the tools in the tools.py file.

Creating the Agents

Agents are the core components of the multi-agent system. They are responsible for analyzing the information and making decisions.

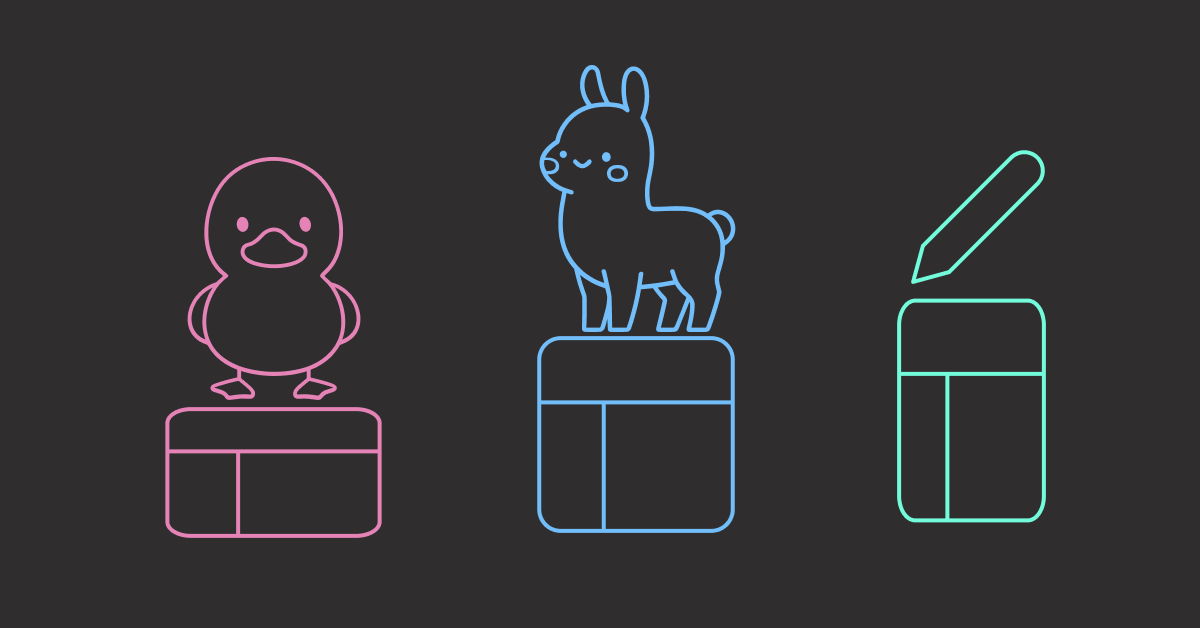

The agents.py file creates the agents and supervisor. There are three specialized agents:

- Bull agent: An optimistic analyst who searches for positive indicators and growth potential

- Bear agent: A pessimistic analyst who identifies risks and negative signals

- Chairman agent: A neutral decision-maker who weighs both sides and makes final investment recommendations

Each agent gets created with the create_react_agent function with the following parameters:

model: The language model to usetools: The tools to useprompt: The system prompt to usename: The name of the agent

Here is the code for the three agents:

def create_bull_agent():

"""Create the bull (optimistic) investment agent"""

return create_react_agent(

model=MODEL_NAME,

tools=[find_positive_news, calculate_growth_potential],

prompt=BULL_AGENT_PROMPT,

name="bull_agent",

)

def create_bear_agent():

"""Create the bear (pessimistic) investment agent"""

return create_react_agent(

model=MODEL_NAME,

tools=[find_negative_news, assess_market_risks],

prompt=BEAR_AGENT_PROMPT,

name="bear_agent",

)

def create_chairman_agent():

"""Create the chairman (decision maker) agent"""

return create_react_agent(

model=MODEL_NAME,

tools=[get_current_market_sentiment, make_investment_decision],

prompt=CHAIRMAN_AGENT_PROMPT,

name="chairman_agent",

)

The supervisor combines all agents under coordinated workflow management. Here is the code for the supervisor:

def create_investment_supervisor():

"""Create the supervisor that manages the investment committee"""

bull_agent = create_bull_agent()

bear_agent = create_bear_agent()

chairman_agent = create_chairman_agent()

supervisor = create_supervisor(

model=init_chat_model(MODEL_NAME),

agents=[bull_agent, bear_agent, chairman_agent],

prompt=SUPERVISOR_PROMPT,

add_handoff_back_messages=True,

output_mode="full_history",

).compile()

return supervisor

In this code:

add_handoff_back_messages=Trueensures agents can reference each other’s previous arguments, creating true conversational debate rather than isolated analysis.output_mode="full_history"provides complete conversation context, allowing you to see the full reasoning process rather than just final decisions.

Formatting the Output

To format the output, we use the pretty_print_messages function in utils.py. It takes the conversation stream updates and formats them into readable output by:

- Identifying which agent is speaking

- Processing supervisor workflow updates and agent interactions

- Converting message objects into a human-readable format

This allows us to clearly see the back-and-forth debate between agents as they analyze investment opportunities.

while True:

try:

stock_input = input("Enter stock symbol (or 'quit' to exit): ").strip()

if stock_input.lower() in ["quit", "exit", "q"]:

print("\n👋 Goodbye! Happy investing!")

break

if not stock_input:

print("Please enter a valid stock symbol.")

continue

analyze_stock(supervisor, stock_input)

except KeyboardInterrupt:

print("\n\n👋 Goodbye! Happy investing!")

sys.exit(0)

except Exception as e:

print(f"\n❌ Error: {e}")

print("Please try again with a different stock symbol.")

Adding a Terminal-based Chatbot Interface

Next, let’s set up an interactive command-line interface that makes the investment committee system accessible to users.

In the main.py file, we set up the welcome message that will be displayed when the application is initialized:

def print_welcome():

"""Print welcome message and system description"""

print("💼 INVESTMENT COMMITTEE SYSTEM")

print("=" * 50)

print("🐂 Bull Agent: Finds reasons to BUY")

print("🐻 Bear Agent: Finds reasons to AVOID")

print("🎯 Chairman: Makes final decision")

print("=" * 50)

Next, create the analyze_stock function that handles the core interaction pattern:

def analyze_stock(supervisor, stock_symbol):

"""Analyze a stock using the investment committee"""

print(f"\n📈 ANALYZING: {stock_symbol.upper()}")

print("-" * 30)

user_query = f"Should I invest in {stock_symbol} stock? I want to hear both bullish and bearish arguments before making a decision."

for chunk in supervisor.stream(

{

"messages": [

{

"role": "user",

"content": user_query,

}

]

},

):

pretty_print_messages(chunk, last_message=True)

The function:

- Takes the stock symbol and constructs a natural language query asking for investment advice

- Uses

supervisor.stream()to get real-time updates from each agent as they analyze the stock - Displays agent responses incrementally using

pretty_print_messages()to show the analysis process

Testing and Running the System

Now we are ready to test and run the system! Run the main.py script to start the application:

python main.py

You will be prompted to enter a stock symbol. Let’s try it with NVDA:

💼 INVESTMENT COMMITTEE SYSTEM

==================================================

🐂 Bull Agent: Finds reasons to BUY

🐻 Bear Agent: Finds reasons to AVOID

🎯 Chairman: Makes final decision

==================================================

🔄 Initializing investment committee...

✅ Committee ready!

Enter stock symbol (or 'quit' to exit): NVDA

The output will look like this:

📈 ANALYZING: NVDA

------------------------------

...

================================== Ai Message ==================================

Name: supervisor

**Summary:**

The bullish case for NVDA centers on historic revenue and profit growth, AI market dominance, ecosystem lock-in, and robust financial momentum. The bearish side warns of bubble-like valuation, heavy customer concentration, rising competition, geopolitical risks, and the potential for hardware cycle reversals. The chairman ultimately recommends a HOLD or further research, acknowledging both the powerful growth story and the elevated risks, making it prudent to wait for more clarity or a better entry point.

Final Thoughts

The investment committee system demonstrates the power of coordinated AI agents in making complex decisions. By combining specialized agents with different perspectives, we’ve created a system that can:

- Provide balanced analysis through structured debate

- Consider multiple viewpoints simultaneously

- Make informed decisions based on comprehensive data

- Adapt to new information through real-time updates

This approach can be extended to other domains where multiple perspectives and structured decision-making are crucial, such as risk assessment, policy analysis, or strategic planning.

📚 Want to go deeper? Learning new techniques is the easy part. Knowing how to structure, test, and deploy them is what separates side projects from real work. My book shows you how to build data science projects that actually make it to production. Get the book →

Stay Current with CodeCut

Actionable Python tips, curated for busy data pros. Skim in under 2 minutes, three times a week.